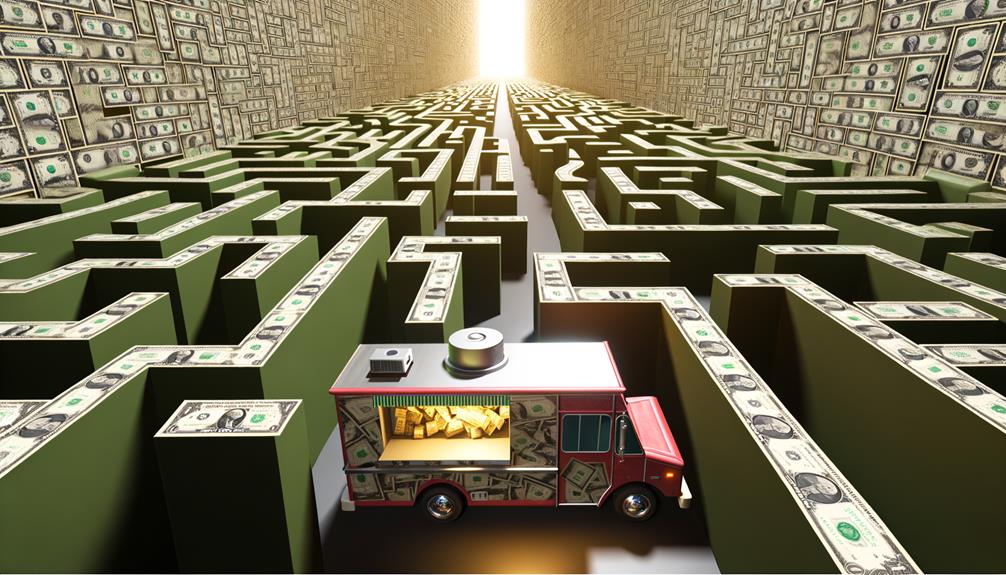

When Mama's Pizza Shack invested in a food trailer to take their famous pies on the road, they didn't anticipate the maze of finding the right general liability insurance.

Indeed, it's a journey many food trailer operators set out on, maneuvering through complex insurance policies to protect their mobile eatery from potential liabilities.

The right insurance is more than just a safety net—it's a shield that lets these entrepreneurs focus on what matters most: their food.

So, what's the secret to finding the right policy? Well, it's not as simple as you might think.

Key Takeaways

- Understanding general liability insurance is key to protecting a food trailer business from potential lawsuits and unexpected incidents.

- Evaluating different insurance providers based on quotes, coverage limits, and reputation can help find the best fit for your business.

- The cost of food trailer insurance is influenced by factors like coverage limits, additional coverages, and tailored plans.

- Making the final decision involves ensuring adequate coverage limits and including additional coverages for a comprehensive insurance package.

Understanding General Liability Insurance

When it comes to managing a food trailer business, understanding general liability insurance – which covers bodily injury, property damage, and advertising injury claims – is a crucial step to ensuring the financial well-being and risk management of your enterprise. This type of insurance is designed to provide coverage against third-party injuries and property damage that may occur during the course of business operations.

Such coverage often proves to be a lifeline for food trailer businesses, protecting them against potential lawsuits and financial liabilities. If an accident occurs, causing bodily injury to a customer or damage to their property, general liability insurance can help cover the associated medical costs and legal expenses, ensuring the continuity of your food trailer business.

Advertising injury claims, although less common, can also be a significant risk. If your food trailer inadvertently infringes on another business's copyright or brand, you could face a hefty lawsuit. Fortunately, general liability insurance can help shoulder the financial burden of such instances, offering invaluable protection.

Importance of Food Trailer Insurance

In the domain of food trailer operations, securing the right general liability insurance isn't just an option – it's a critical safeguard that can shield entrepreneurs from devastating financial losses. Food trailer insurance is an essential tool in building a resilient business, offering protection against unexpected scenarios.

- Coverage for Property Damage and Injury: General liability insurance typically includes a $2,000,000 limit, protecting food trailer owners from lawsuits related to property damage or injuries. This guarantees you can continue to serve your community without the worry of costly legal disputes.

- Protection for Tools & Equipment: With coverage up to a $10,000 limit, your essential tools and equipment are safeguarded against theft or damage.

- Legal Compliance and Business Continuity: Many event locations mandate food trailers to have general liability insurance, making it essential for maintaining business operations and legal compliance.

- Cyber Liability Insurance and Support from Licensed Agents: In addition to general coverage, you can benefit from specific protections like cyber liability insurance. Licensed agents provide expert knowledge, helping you navigate your insurance needs effectively.

Evaluating Different Insurance Providers

Choosing the right insurance provider for your food trailer involves careful comparison of quotes, assessment of coverage limits, and consideration of each provider's reputation and customer reviews. General liability insurance is a critical factor in safeguarding your business, and providers should offer thorough coverage with sufficient limits.

Reputation is a key element in the evaluation process. Providers with a positive reputation have shown their reliability and dedication to serving clients. Customer reviews can give insights into how providers handle claims and their overall service quality.

Additional benefits such as online policy management and claims support can make the difference between providers. Online policy management allows for easy accessibility and control over your insurance policy, while claims support ensures you have assistance during stressful times.

Experience and expertise in insuring food trailers enable providers to tailor coverage to your specific needs. These providers understand the unique risks associated with food trailers and can offer suitable solutions.

Cost Factors in Food Trailer Insurance

Understanding the cost factors in food trailer insurance, which can start at $299 annually or $25.92 monthly, is essential for ensuring your business is adequately protected. The price is determined by considering several factors, ranging from general liability to tailored coverages.

- General Liability: This is a fundamental part of food trailer insurance. It covers third-party lawsuits over bodily injury, property damage, and food-related claims. The coverage limit typically starts at $2,000,000 per occurrence.

- Additional Coverages: Food trailer owners can opt for additional coverages like cyber liability protection and tools & equipment insurance. These provide added security against modern risks and unexpected equipment damage, respectively.

- Personalized Insurance: Insurance providers offer personalized insurance plans tailored to the unique needs of the food trailer business. This means you can adjust your coverage limits and terms to match your specific requirements.

- Tailored Coverages: Some insurance providers offer coverage for specific risks associated with food trailers. This may include coverage for food spoilage, equipment breakdown, and more.

Making the Final Insurance Decision

Weighing your insurance options carefully is important to securing the right protection for your food trailer business. It's vital to guarantee the coverage limits of your liability insurance, such as a $2,000,000 limit, which provides significant defense against lawsuits and claims.

A thorough evaluation of the policy's coverage for potential risks, like bodily injury, property damage, food-related claims, and equipment damage, is necessary to assure thorough protection. These aspects are foundational to a detailed insurance package, safeguarding the business from a range of potential threats.

Additionally, additional coverages can further fortify your business. Options like cyber liability insurance protect against digital threats, while tools and equipment insurance cover the specific needs of a food trailer.

The inclusion of free unlimited additional insureds and access to licensed agents for personalized coverage can make insurance more tailored to your business. These aspects contribute to a more holistic and personalized coverage, addressing unique needs and providing a safety net for unforeseen incidents.

Frequently Asked Questions

Which of the Following Is Covered by General Liability Insurance?

General liability insurance covers bodily injury, property damage, and advertising injuries. It includes policy benefits like legal fees and settlements, but it's important to understand coverage limitations, policy exclusions, and the claim process.

What Cost Does Commercial General Liability Insurance Not Cover _________________?

Commercial general liability insurance doesn't cover employee injuries, damage to one's own property, or professional errors. It also excludes intentional wrongdoing, certain product recalls, pollution incidents, and other uninsured losses.

What 2 Types of Insurance Listed in the Article Have Liability Coverage?

In evaluating trailer safety and policy comparisons, two types of insurance offering liability coverage for food truck operations are General and Auto Liability Insurance. They manage liability risks despite coverage limitations, influencing insurance rates and insurer selection.

Which One of the Following Losses Would Be Covered by Coverage a of the Commercial General Liability?

He'd find that Coverage A typically covers losses like slip and fall accidents or property damage. It'd handle damage assessment, legal implications, and claim filing, providing significant benefits despite policy limits and premium calculations.

Conclusion

In the final analysis, traversing the maze of general liability insurance is much like crafting the perfect recipe for your food trailer. It requires careful evaluation, understanding the key ingredients like coverage, and selecting the right provider.

The cost factors are much like seasoning – essential, but shouldn't overpower the dish. Like a master chef, you must balance all these aspects to certify your business is well-protected and ready to serve up success.