Exploring the treacherous waters of small business insurance can often feel like a challenging task. From general liability to workers' compensation, there's a variety of coverage types that need meticulous understanding and careful decision-making.

With numerous options at one's disposal, the question becomes: how does a small business owner construct a thorough insurance plan that's tailor-made for their specific business needs? Stick with us to uncover the answer, and in the process, learn how to protect your business from unforeseen mishaps.

Key Takeaways

- Small businesses need both general liability and workers' compensation insurance to mitigate financial risks.

- General liability insurance protects against third-party claims, while workers' compensation covers employee-related incidents.

- Comprehensive general liability insurance offers broader protection, including reputational harm and advertising injury.

- Choosing the right insurance involves understanding specific risks and business nature, which influence insurance costs.

Understanding General Liability Insurance

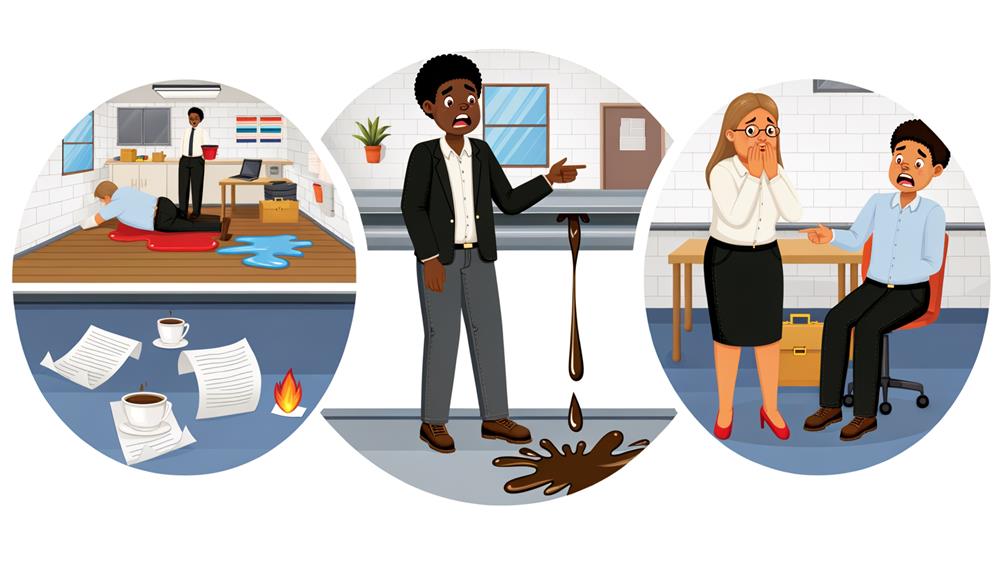

Diving into the domain of general liability insurance, it's important to grasp that this type of coverage safeguards businesses against property damage to others' belongings and bodily injuries to clients visiting the premises. Known as commercial liability insurance, this policy provides an essential safety net for various liability claims that may arise.

However, this insurance doesn't extend to protect a business's personal property or employee injuries. For such cases, additional coverage, such as property insurance, is required. This highlights the importance of a thorough business owners policy, which caters to the diverse needs of small business owners.

General liability insurance is particularly crucial for businesses allowing client visits, as it minimizes the financial risks associated with potential accidents. It's recommended for most businesses, especially those working with customers or offsite employees.

Acting as a minimum coverage, general liability insurance provides protection against property damage and bodily injury claims. As a result, it's a significant asset for small businesses, serving as a primary line of defense against unexpected mishaps. By understanding the scope of general liability insurance, small business owners can make sure they're adequately protected, and focus on serving others.

Exploring Workers Compensation Insurance

Shifting our focus to workers compensation insurance, it's an important safety net that covers medical expenses, disability, lost wages, and death benefits arising from work-related injuries or illness. This type of coverage is mandated in most states, offering protection for both employees and employers.

When discussing workers compensation insurance, a few key elements stand out:

- Workers comp benefits are extensive, covering medical expenses and lost wages, providing death benefits, and allowing for disability payments in the event of a work-related injury or illness.

- Claims history plays a vital part in determining the premium. A clean claims history can result in lower premiums, while a history of numerous claims can lead to increased costs.

- Legal consequences may arise for businesses that don't provide the required coverage. This can range from fines to criminal charges, underscoring the importance of compliance.

Workers compensation insurance is a practical component of a thorough business insurance plan, ensuring the welfare of employees while protecting the business from potential financial and legal fallout. By having a proper understanding of workers compensation insurance, small businesses can confidently navigate the complexities of insurance planning.

Choosing Your Business Insurance

When it comes to choosing your business insurance, it's critical to understand the role of both general liability and workers' compensation insurance in protecting your company from different risks and liabilities. General liability insurance shields your business from claims that can arise from everyday operations, such as property damage and bodily injuries to third parties. This coverage is particularly vital for businesses that interact with customers regularly, as it safeguards them from potential legal complications.

On the other hand, workers' compensation insurance, often referred to as workers comp, offers benefits for work-related injuries or illnesses. It covers medical bills, lost wages, disability benefits, and even death benefits. For most businesses with employees, procuring workers comp isn't just a wise decision but a legal requirement.

A thorough understanding of these insurance types is key in selecting the right coverage for your small business. Remember, the goal is to minimize risk and liability. Hence, evaluating your business's specific risks will help determine the necessity for both general liability and workers' comp insurance. In the end, the right business insurance choices will make sure your small business is adequately protected against various claims and liabilities.

Workers Compensation Vs General Liability

- Workers' compensation is primarily oriented towards employee welfare. It covers employee injuries and compensates for lost wages when an employee is unable to work due to a work-related injury. Workers' compensation is generally mandatory for most businesses with employees according to state laws.

- General liability, on the other hand, provides protection against third-party claims. This could include third-party bodily injuries or property damage caused due to the business's operations. Unlike workers' compensation, general liability isn't required by law, but it's highly recommended given the potential financial implications of a claim.

- The cost of these insurances also varies. Workers' comp rates average around 93 cents per $100 of payroll annually. In contrast, general liability costs fluctuate based on business size and risk.

Comprehensive General Liability Insurance

While general liability insurance provides broad coverage, a more all-encompassing policy known as Extensive General Liability Insurance offers businesses extensive protection against a wide range of risks. This type of insurance is particularly beneficial for small businesses, as it provides coverage for injuries to non-employees, property damage, and other specific hazards.

Extensive General Liability Insurance lends financial protection to a business by covering claims for property damage, slip-and-fall injuries, reputational harm, and advertising injury. It also encompasses medical payments, providing an overall safety net for potential risks.

Aside from coverage, this insurance plays an important role in handling legal fees and defense costs that arise from claims, even if the small business isn't at fault. This feature of extensive coverage ensures that businesses aren't financially crippled by unexpected legal costs.

The cost of Extensive General Liability Insurance depends on various factors. These include the nature of the business, the number of employees, location, claims history, work experience, deductibles, and policy limits. Businesses with good safety records in low-risk industries may enjoy lower premiums, making it a viable and cost-effective option for risk management.

Frequently Asked Questions

Is Comprehensive Insurance the Same as General Liability?

No, they're not the same. All-inclusive insurance encompasses various coverages, including general liability. It's broader, covering more business vulnerabilities and offering higher protection levels against potential claims, fulfilling diverse legal requirements.

What Is the Difference Between GL and WC Insurance?

"GL and WC insurance differ in coverage, legal obligations, and cost. GL covers third-party claims, while WC benefits employees. WC's mandatory; GL isn't. Costs vary, based on factors like industry and location."

What Is a Comprehensive General Liability CGL Policy?

A Thorough General Liability (CGL) policy offers key legal protection, covering liability exclusions and risks. It's important in risk assessment, considering policy inclusions, endorsements, premium costs, and underwriting. It simplifies the claim process for businesses.

What Is Covered Under CGL Policy?

Under a CGL policy, they're covered for a universe of risks. It includes property damage, injuries, reputational harm, and even advertising injury. However, it's not a magic shield; some exclusions apply based on policy limitations.

Conclusion

In sum, creating a thorough insurance plan is no small feat, it's akin to maneuvering an ancient labyrinth. A firm grasp of general liability and workers' compensation insurance is crucial to safeguard your venture.

By astutely choosing your coverage, comparing policies, and staying abreast with changes, you secure your business's armor is ever fortified.

Regardless of the twists and turns your business takes, the right insurance can be your reliable compass, guiding you through potential risks.